Data from Barratts Developments, Britain’s biggest house builder, summed up exactly why property prices in London are going to stay high – properties are not being built fast enough.

Britain, especially London, is suffering from a housing crisis where not enough homes are being built to sate demand.

In a densely populated urban area like London, this problem is more acute. If supply is tight but demand remains high, it pushes up the prices.

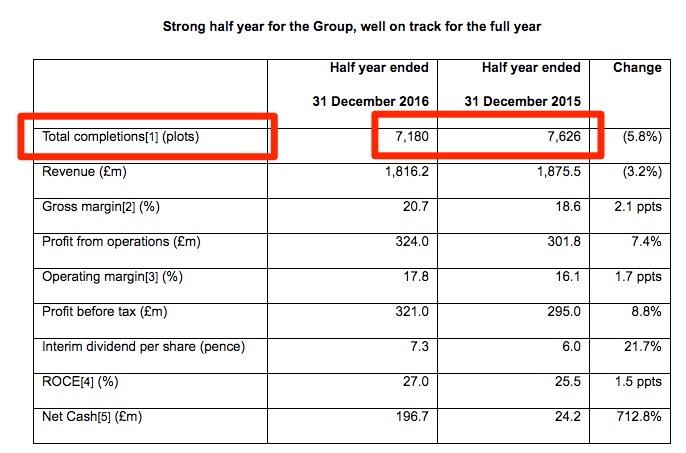

And in Barratts’ half year results, the company said pre-tax profit increased by 8.8% to £321 million in the six months to December because “completions outside of London at highest level for nine years.”

However, London production slowed down:

At the moment, the average property price in London is at £484,000, according to the Office for National Statistics. The average wage hovers around £30,000, so buying a property in Britain's capital is pricey.

However, it does not look like London property prices are going to get any more affordable any time soon, if wages do not rise as quickly as house prices inflate.